As international students, we can file our taxes with the Volunteer Income Tax Assistance program can help you prepare your US and Oklahoma returns. Located at UCO in the College of Business, the VITA program is one of the few VITA sites in Oklahoma that files taxes for international students.

IMPORTANT NOTE: The IRS requires that all international students on F or J visas file their taxes. Even if you did not earn any income while studying in the US, the IRS requires you to file Form 8843. Failure to comply with US tax requirements can revoke your visa.

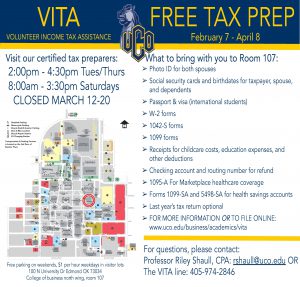

Time and Days:

- February 7th – April 8th, 2023

- Tuesdays and Thursdays: 2:00 PM – 4:30 PM

- Saturdays: 8:00 AM – 3:30 PM

- VITA will be closed March 11-18th for Spring Break.

Please note: VITA stops accepting new clients at 1:30 PM on Saturdays

Location: Room 107, College of Business

What to Bring:

- Passports

- Visas

- Any 1042-S forms received from 2022 employers

- W-2’s

- 1099 forms

- Charitable contribution receipts

For any questions, you can contact:

· Professor Riley Shaull, CPA: rshaull@uco.edu

· VITA line: (405) 974-2846